CLOB vs AMM

Why CLOBs Outshine AMMs in the Trading Arena

In the dynamic world of cryptocurrency exchanges, two prominent trading mechanisms stand out: Automated Market Makers (AMMs) which put decentralised exchanges (DEXs) on the map, and the Central Limit Order Books (CLOBs) that have been prevalent in traditional finance (TradFi) and near-universally used by centralised exchanges (CEXs). While both have their merits, CLOBs demonstrate distinct advantages, especially for active traders seeking control and efficiency in market making. Although this has been well-known since the dawn of AMMs, it is useful to recap the differences between these mechanisms, as new technological improvements in blockchain finally allow CLOBs to reach the decentralised world.

The AMM Approach: Set, Forget, and Risk

AMMs revolutionized DeFi by enabling a formula-driven approach to asset pricing and ratios. This simplicity was not only a necessity given the gas requirements of settling in L1, but moreover it majorly attracted retail investors, offering a “set and forget” style of market participation which was packaged as a simple “yield” product i.e. the liquidity pool or LP. However, the very nature of AMMs exposes traders to the whims of the broader market, often leading to the dreaded “sitting duck” dynamics. As the market as a whole swings in pricing, AMM participants cannot help but “to be rebalanced” by more active traders, which results in the derided “impermanent loss”.

The CLOB Edge: Active, Controlled, and Enhanced Liquidity

In contrast, CLOBs elevate trading and market making to a level of sophistication unmatched by simple formulas or bonding curves. In the CLOB model, asset prices and ratios emerge from a diverse array of bids and asks placed by market makers, rather than being bound to a preset formula. This approach is designed for active and strategic market participation, where traders can finely tune their bids and asks. The agility of this system allows them to not only earn from market activity but also actively manage risk exposure. Far from being “sitting ducks,” market makers in CLOBs often significantly influence market prices. They strategically range their bids and asks to create substantial depth around the most advantageous prices, balancing their desire for profit against the need to shield themselves from market volatility. This dynamic results in deeper market liquidity, a critical advantage that retains its significance even amid advancements in AMM technologies like liquidity ranges.

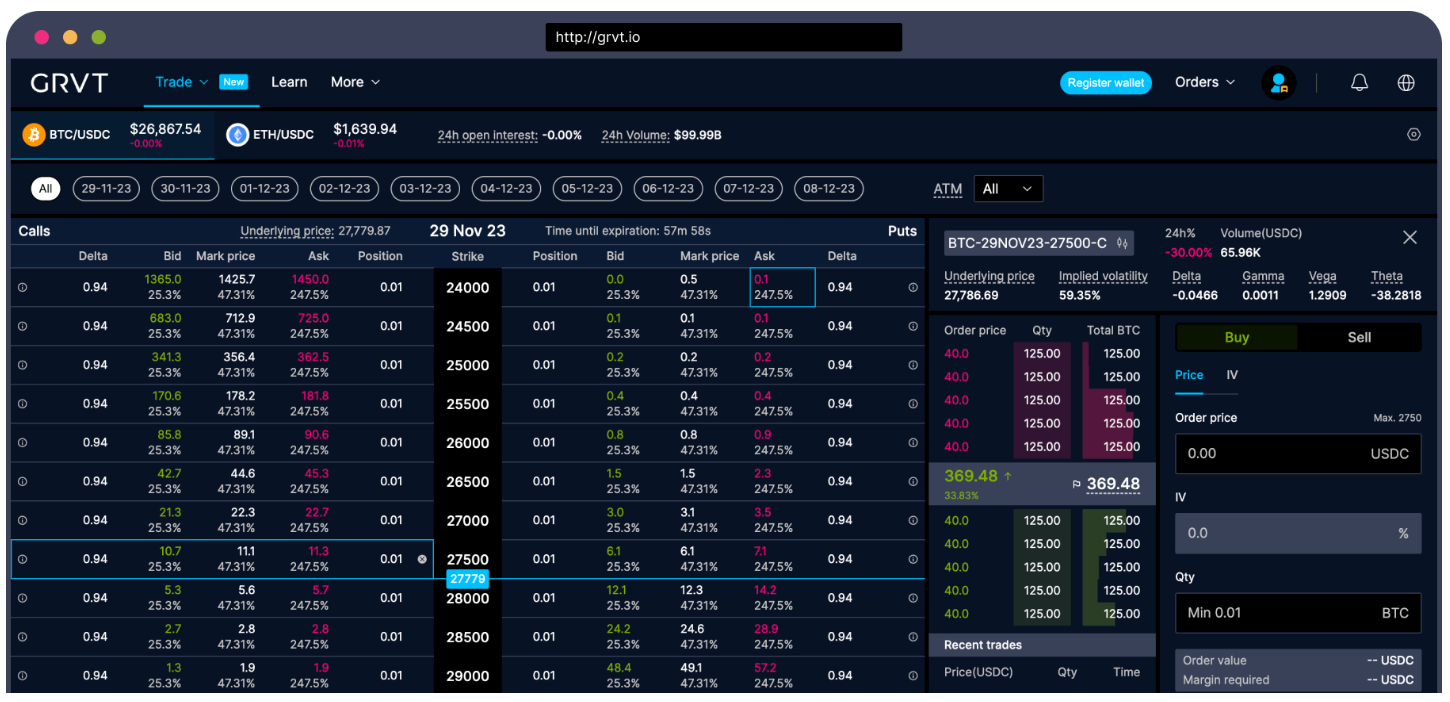

Mastering Your Market Destiny with GRVT’s hybrid CLOB

GRVT was designed to bring the CLOB model once and for all to the decentralised world. We are deep believers in the CLOB mechanism because we understand active market participants do not want to be “sitting ducks” as they are under the AMM mechanism. Each participant in a CLOB environment controls their exposure through their individual orders. This autonomy enables traders to respond swiftly to market changes, a crucial advantage in the fast-paced DeFi market.

Conclusion: CLOB for the Active Trader

While AMMs democratized market access in DeFi, CLOBs cater to those seeking an active role in their trading journey. Whereas CLOBs could not break into DeFi during its nascent years, state-of-the-art advances in blockchain technology have made CLOBs compatible once more with decentralised application architectures. By bringing the CLOB mechanism to a hybrid exchange that is as secure and non-custodian as any AMM, GRVT empower traders to be masters of their market destiny, providing them a superior choice than many in the DeFi ecosystem.